Automotive

Steel Offers Durable, Cost-Effective Solutions for Automotive Vehicles

Steel currently makes up about 54 percent of the average vehicle. Americans depend on automobiles to keep families safe. In addition to its strength, durability and dependability, steel is also the key to recycling a car at the end of its long life — as steel is continuously recyclable.

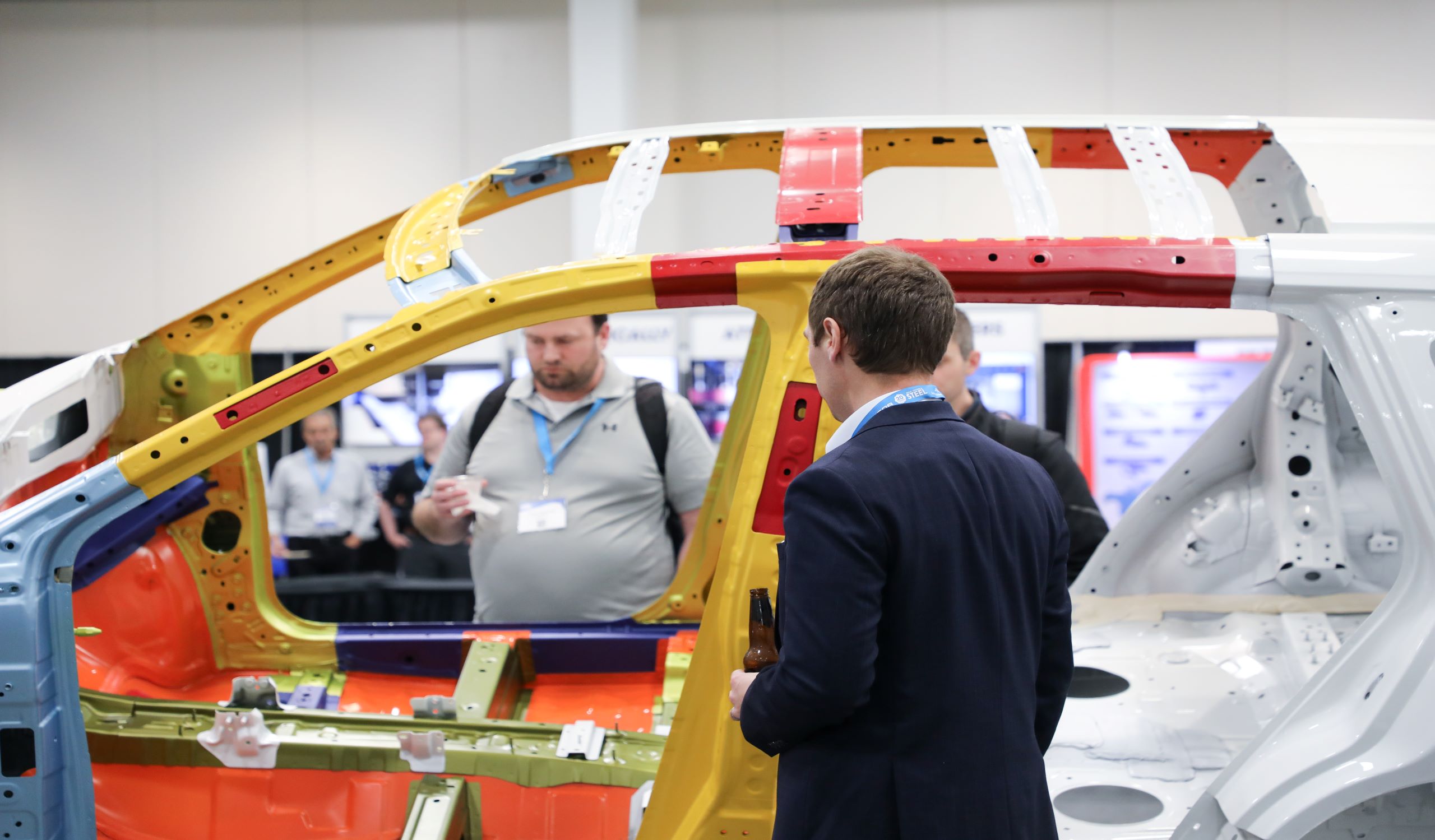

The American steel industry continues to invest in advanced materials and manufacturing technologies that have led to the introduction of a wide variety of new automotive steels. These advanced high-strength steels (AHSS) are strong, lighter, and produced with light life cycle impact, helping automakers decrease a vehicle’s life-long carbon footprint. This helps auto manufacturers to reduce the mass of vehicles while maintaining safety standards — thereby increasing fuel economy and reducing tailpipe emissions. The use of current grades of AHSS can reduce a vehicle’s structural weight by as much as 25 percent and can cut total life cycle CO2 emissions by up to 15 percent more than any other automotive material.

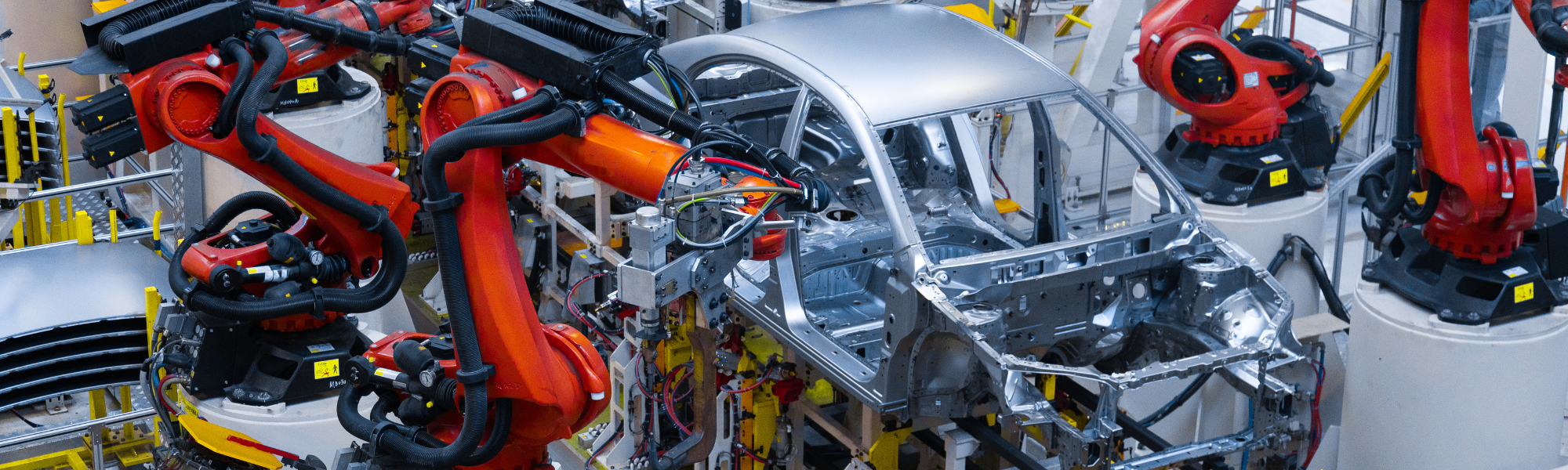

With more than 200 steel grades available, today’s products are six times stronger than those of a decade ago. The steel industry continues to innovate by introducing new grades and manufacturing processes in support of future mobility, which promises to revolutionize the transportation industry through the proliferation of electrified, connected, and shared autonomous vehicles.

As electric vehicles become more commonplace and battery efficiencies improve, use of advanced grades of steel enable reduced weight resulting in a greater range from a single electrical charge.

The American steel industry, working with the automotive industry, continues to revolutionize the safety and durability of cars, while reducing environmental impacts. For more information, enter here.

Read our report: Consequential Life Cycle Greenhouse Gas Study of Automotive Lightweighting with Advanced High Strength Steel (AHSS) and Aluminum.

Now Available

-

AISI President and CEO Quoted in Wards Auto

April 3, 2024 -

Great Designs in Steel 2024 in MetalForming Magazine

February 12, 2024 -

AISI’s Kristock Featured in MetalForming Magazine

November 1, 2023 -

American Iron and Steel Institute Announces New Website Search Tool for Past Great Designs In Steel Presentations

June 26, 2023 -

Nissan Receives Award At 21st Annual Great Designs In Steel Symposium For Innovative Use of Advanced High-Strength Steel

May 24, 2023 -

American Iron and Steel Institute Announces New VP of Auto Program

June 21, 2022 -

Ford Receives Award For Use Of Steel Lightweighting In EVs at 20th Annual Great Designs In Steel Symposium

May 18, 2022 -

AISI Applauds Senate Passage of Infrastructure Bill

August 10, 2021 -

AISI Welcomes Administration Executive Order on Electric Vehicles

August 5, 2021 -

Paper on Advanced High Strength Steels Above 1 GPa Wins 2021 SAE/AISI Sydney H. Melbourne Award

July 15, 2021

![[AISI LOGO]](https://www.steel.org/wp-content/themes/steel-org/assets/images/steel-logo.png) American

Iron and Steel

Institute

American

Iron and Steel

Institute